vadimdyl.ru Categories

Categories

Does Amazon Prime Offer Free Shipping

Amazon Prime members shipping to select metro areas across the US can choose to receive FREE Same-Day Delivery on a broad selection of items. An Amazon Prime membership costs $ per year. Benefits include free two-day shipping, video streaming and Grubhub+. Here's how to decide if Amazon Prime. No. With Prime, you get free two-day shipping on many of the items that Amazon sells. However, you don't get free two-day shipping on everything. Millions of people have an Amazon Prime subscription for one reason: you can get just about anything shipped to your house in two days, with no extra. The "Eligible for Free Shipping" option only applies to Subscription purchases, i.e. those that Amazon wants you to select and then have it automatically. I save a lot of money, and even have access to free shipping, albeit with some caveats. By Alex Kantrowitz. Jan 31, AM. Shipping · FREE Two-Day Shipping on eligible items to addresses in the contiguous US and other shipping benefits. · FREE Same-Day Delivery in eligible zip codes. Prime Membership Plans Comparison ; Free Release-Day Delivery, Yes ; FREE No-Rush Shipping, Yes ; Amazon Day, Yes ; Streaming and digital benefits, Prime Video, Yes. FREE Two-Day Shipping. Items sold by vadimdyl.ru that are marked on the product page and at checkout. Many items that are fulfilled by Amazon. Amazon Prime members shipping to select metro areas across the US can choose to receive FREE Same-Day Delivery on a broad selection of items. An Amazon Prime membership costs $ per year. Benefits include free two-day shipping, video streaming and Grubhub+. Here's how to decide if Amazon Prime. No. With Prime, you get free two-day shipping on many of the items that Amazon sells. However, you don't get free two-day shipping on everything. Millions of people have an Amazon Prime subscription for one reason: you can get just about anything shipped to your house in two days, with no extra. The "Eligible for Free Shipping" option only applies to Subscription purchases, i.e. those that Amazon wants you to select and then have it automatically. I save a lot of money, and even have access to free shipping, albeit with some caveats. By Alex Kantrowitz. Jan 31, AM. Shipping · FREE Two-Day Shipping on eligible items to addresses in the contiguous US and other shipping benefits. · FREE Same-Day Delivery in eligible zip codes. Prime Membership Plans Comparison ; Free Release-Day Delivery, Yes ; FREE No-Rush Shipping, Yes ; Amazon Day, Yes ; Streaming and digital benefits, Prime Video, Yes. FREE Two-Day Shipping. Items sold by vadimdyl.ru that are marked on the product page and at checkout. Many items that are fulfilled by Amazon.

Enjoy fast, free delivery, just for being a Prime member - including 2-hour delivery on thousands of items! Image of device with video playing. Popular movies &. We can't deliver some products for free due to their nature and the effort involved. Therefore, we exclude such products from free shipping. You Selected. When you shop directly on our site, you see the Buy with Prime button and Amazon Prime delivery promise on eligible products, which signals that the item is. Before diving into the details of weekend deliveries, let's first explore the basics of Amazon Prime's delivery policy. Amazon Prime offers free two-day. A majority of the items shipped directly from an amazon warehouse has a free shipping option, with some restrictions. For example, it might say “free delivery on orders shipped by Amazon over $” Prime members, however, get unlimited free two-day shipping on eligible items. Please be informed that products eligible for Amazon Prime will be designated on the product page and at checkout. If only some items in your purchase are. Free ultrafast delivery on groceries and household essentials · Go to vadimdyl.ru to learn more · Meet minimum order amount* · Checkout using your existing. To qualify for Extended Free Shipping, place an order with at least the stated minimum threshold of eligible items shipped by Amazon and select FREE Shipping. Click the link that says “Free Shipping by Amazon.” Once you click this link, only items that will be eligible for free shipping (with a $35 purchase) will. Free One-Day and Same-Day Delivery: Prime members in the U.S. can shop a selection of over 20 million items eligible for Prime Free One-Day Delivery with no. Prime Delivery: Fast, free, and convenient delivery choices on millions of items, exclusively for Amazon Prime members. If free shipping is your game, Amazon offers free shipping on orders of $25 or more for those without Prime, with delivery in business days (though it's. Available on Prime eligible items sold or shipped by Amazon AU. Eligibility for FREE One-Day delivery will vary depending on the product and your shipping. When you shop directly on our site, you see the Buy with Prime button and Amazon Prime delivery promise on eligible products, which signals that the item is. Starting Monday and for an unspecified limited time, all Amazon customers — and not just Prime members — will get free shipping with no minimum purchase. If your order meets certain requirements and you're shipping to an eligible international destination, you can select the FREE AmazonGlobal Standard Shipping. The "Eligible for Free Shipping" option only applies to Subscription purchases, i.e. those that Amazon wants you to select and then have it automatically. Free release-date delivery: Prime members can have eligible pre-order items delivered on their release date for free. Free no-rush shipping: Members who select. You do not need to use FBA or be a part of the Seller Fulfilled Prime program to offer free shipping on your products. Free shipping can be offered by.

Why Cant I Get Approved For A Secured Credit Card

There are other a number of costs involved with secured cards that make them an expensive way to borrow. Secured cards' annual percentage rates (APRs) tend to. Apply online. If qualified, you'll receive conditional approval · Make a security deposit. Once conditionally approved you'll open a TD Simple Savings account. You may be denied a secured credit card for various reasons, including a lack of credit history, low credit score or no verifiable income. If you've been denied. If you've had trouble getting approved for an unsecured credit card, then a secured credit card might be a good option for you. These cards require a cash. How long will it take for me to receive my Secured Credit Card if I'm approved? When and how do I pay my security deposit? FAQ tick Can I pay my. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit. You don't. Yes. You can apply for any card. The real question should be “Will you get approved for a secured card?” Not necessarily. Use your card wherever credit cards are accepted. It works just like a traditional credit card, and it looks the same, too – merchants can't tell the difference. After the deposit is made, there is still a chance you may not make your monthly payments on time, and many cards charge both interest and late fees for unpaid. There are other a number of costs involved with secured cards that make them an expensive way to borrow. Secured cards' annual percentage rates (APRs) tend to. Apply online. If qualified, you'll receive conditional approval · Make a security deposit. Once conditionally approved you'll open a TD Simple Savings account. You may be denied a secured credit card for various reasons, including a lack of credit history, low credit score or no verifiable income. If you've been denied. If you've had trouble getting approved for an unsecured credit card, then a secured credit card might be a good option for you. These cards require a cash. How long will it take for me to receive my Secured Credit Card if I'm approved? When and how do I pay my security deposit? FAQ tick Can I pay my. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit. You don't. Yes. You can apply for any card. The real question should be “Will you get approved for a secured card?” Not necessarily. Use your card wherever credit cards are accepted. It works just like a traditional credit card, and it looks the same, too – merchants can't tell the difference. After the deposit is made, there is still a chance you may not make your monthly payments on time, and many cards charge both interest and late fees for unpaid.

This step excludes accounts that are secured by an asset, like a car, home, or cash deposit, but includes secured credit card accounts. It also excludes medical. Use your card wherever credit cards are accepted. It works just like a traditional credit card, and it looks the same, too – merchants can't tell the difference. Credit Bureau Reporting: Not all secured credit cards report your card activity to the major credit bureaus. If you obtain a credit card like this, it won't be. Can you be denied a secured credit card? Though secured credit cards might be generally less restrictive about approval than unsecured cards, that doesn't mean. The reasons why a secured credit card application may be denied can vary, but one top reason would be the inability of applicants to pay the required cash. A secured credit card is a great option to build or repair your credit. A secured credit card can be used anywhere credit cards are accepted and the payment. If you miss a few payments or default on your debt, the credit card issuer may keep your deposit to cover those payments. But, if you make regular, on-time. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. You only need to make the deposit once. This deposit acts as a good-faith gesture that shows the card issuer your commitment to repaying your credit balance. Make a refundable deposit. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at. While credit history may be used to determine eligibility for a secured card, the line of credit it offers requires a security deposit. This security deposit. While secured credit cards usually require a security deposit to back your credit limit, this extra requirement makes them easier to get approval for. Secured Credit Cards · Make your monthly payments in full and on time. This is crucial in establishing good credit. · Spend wisely. · Be patient; it will take If you don't have a substantial source of income — or none at all — you may struggle to be approved for a credit card. Missed payments. Having poor payment. This unique account initially requires an upfront deposit like a secured credit card, but will provide you an opportunity to convert into a traditional credit. If you're a first-time borrower or have poor credit, a secured credit card from a financial institution like Navy Federal Credit Union may be the answer. You must not have any pending bankruptcy, or bankruptcy history in the last two years. As with any credit card, you may be declined based on the information you. Most credit cards are unsecured, meaning they're not tied to any collateral. Borrowers will usually need to meet certain credit requirements in order to get. If you are looking to make an upfront cash deposit on your credit card, check out Mastercard's secured credit card options. Explore Mastercard credit cards. If you are looking to make an upfront cash deposit on your credit card, check out Mastercard's secured credit card options. Explore Mastercard credit cards.

What Credit Card Is Good For First Time

Your first and very best choice is Capital One. Go to their website, click on Credit Cards, then look for a link on the page for their pre-. Starter credit cards are a type of credit card designed for consumers who have no credit history or a very limited credit history. Starter credit cards help. Our picks for the best starter credit card include a best secured card for building credit, as well as cash back and travel rewards cards. Capital One SavorOne Student Cash Rewards Credit Card · Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores . U.S. Bank Smartly™ Visa Signature® Card · Coming Soon: Earn up to 4% cash back on every purchase · Find a credit card that fits your lifestyle. · Build credit for. Best credit cards with no annual fee in September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card. "Secured" credit cards are often the best choice for anyone trying to establish credit for the first time. A secured card means that a security deposit is. There's no standard recommended age for when you should get your first credit card, so long as you meet the minimum required age (either 18 or 19) in your home. Winner: Best credit card for beginners. Chase Freedom Rise℠ Credit Card* · ; Best travel credit card for beginners. Discover it® Miles · ; Best starter. Your first and very best choice is Capital One. Go to their website, click on Credit Cards, then look for a link on the page for their pre-. Starter credit cards are a type of credit card designed for consumers who have no credit history or a very limited credit history. Starter credit cards help. Our picks for the best starter credit card include a best secured card for building credit, as well as cash back and travel rewards cards. Capital One SavorOne Student Cash Rewards Credit Card · Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores . U.S. Bank Smartly™ Visa Signature® Card · Coming Soon: Earn up to 4% cash back on every purchase · Find a credit card that fits your lifestyle. · Build credit for. Best credit cards with no annual fee in September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card. "Secured" credit cards are often the best choice for anyone trying to establish credit for the first time. A secured card means that a security deposit is. There's no standard recommended age for when you should get your first credit card, so long as you meet the minimum required age (either 18 or 19) in your home. Winner: Best credit card for beginners. Chase Freedom Rise℠ Credit Card* · ; Best travel credit card for beginners. Discover it® Miles · ; Best starter.

Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. You have a current balance on a card that you want to pay down. · You have a large purchase to make and need extra time to pay it off. · Earning rewards isn't. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Best for a limited credit history: Capital One QuicksilverOne Cash Rewards Credit Card. Here's why: Capital One says this card is for people with fair credit. The best first credit card to build credit with is the Petal® 2 Visa® Credit Card. The card has a $0 annual fee, does not require a security deposit, and. credit and help you establish a successful financial future when handled responsibly. Choose from these Bank of America® credit cards to find the best fit. Spending below your credit limit is an essential step toward reaching a good credit score. The rule of thumb is to not spend more than 30% of your credit limit. For the bank, this deposit acts as collateral in case you don't pay your bills each month. Some of the best secured cards include the Capital One Platinum. How best to use your credit card · Do make the minimum monthly repayments. Better still, pay off as much as you can afford to, to avoid paying unnecessary. Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything · Discover it® Student Chrome: Best for Student cards: Simplicity and value. The Scotiabank®* Platinum American Express® Card has a % annual interest rate (many credit cards charge between 19% to %). This interest rate extends. Winner: Best credit card for beginners. Chase Freedom Rise℠ Credit Card*. Essentially, the way secured credit cards work is that you put down a deposit — let's say $ — which then becomes your credit limit for that account. Because. First-time credit card users may find the Chase Freedom Unlimited credit card useful thanks to a low annual fee and low intro APR period of 15 months. The best first credit card to build credit with is the Petal® 2 Visa® Credit Card. The card has a $0 annual fee, does not require a security deposit, and. Secured cards are ideal first-time credit cards because they're typically easier to get approved for. This particular card has no annual fee but requires users. Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. Secured credit cards are another option for people with little or no credit history. Unlike unsecured credit cards, secured credit cards typically require you. Cash bonuses on cards with no annual fee · Wells Fargo Active Cash® Card · U.S. Bank Altitude® Go Visa Signature® Card · Bank of America® Customized Cash Rewards.

Can You Borrow From Your Life Insurance Policy

No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that. You can borrow money against permanent life insurance policies that have cash value. Some types of permanent policies you can borrow from include whole life. Yes. The money can be used for any purpose including buying a home. The value of a life insurance policy belongs to the owner of the policy, and they are free. Your life insurance policy can help you beyond its death benefit. · Pay your premiums with cash value · Use cash value for a loan · Tap your life insurance for. A policy loan allows you to borrow against your life insurance policy, specifically applicable to most permanent cash-value life insurance policies. Can I borrow money from my life insurance to buy a house? Yes, if your permanent or whole life insurance policy has accumulated enough cash value, you may be. If you need cash and want to take it from your life insurance policy, you typically have four options: withdraw, borrow, surrender, or sell. Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment . No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that. You can borrow money against permanent life insurance policies that have cash value. Some types of permanent policies you can borrow from include whole life. Yes. The money can be used for any purpose including buying a home. The value of a life insurance policy belongs to the owner of the policy, and they are free. Your life insurance policy can help you beyond its death benefit. · Pay your premiums with cash value · Use cash value for a loan · Tap your life insurance for. A policy loan allows you to borrow against your life insurance policy, specifically applicable to most permanent cash-value life insurance policies. Can I borrow money from my life insurance to buy a house? Yes, if your permanent or whole life insurance policy has accumulated enough cash value, you may be. If you need cash and want to take it from your life insurance policy, you typically have four options: withdraw, borrow, surrender, or sell. Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment .

Depending on what type of life insurance policy you have, the loan can even be tax-free, unlike simply withdrawing money from the policy. You can choose not to repay, but the outstanding loan balance will typically be deducted from your death benefit. A policy loan can be a helpful option if you. You may make a loan against the cash value of the policy at a specified rate of interest or a variable rate of interest but such outstanding loans, if not. You can borrow against your life insurance policy as soon as your policy has built up enough cash value to do so. While the exact timeframe depends on your. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most cases. Cash value can be withdrawn in the form of a loan or it can be used to cover your insurance premiums. All loans must be repaid before you pass or they will be. If the loss of your income would negatively impact those who depend on you, consider adding a term life policy to a whole life policy. Term life insurance can. You can borrow money from a permanent life insurance policy once the cash value has built up to the borrowing threshold. Your life insurance company will make payments after your death to the person you name in your policy. This person is called your beneficiary. You can name more. A policy loan can be requested by completing sections 1, 6 & 7 of the Policy Service form and signing on page 4. Please be advised that a loan against your. You cannot borrow money from your term life insurance policy because it does not have a cash component. This is one of the reasons why term. You can borrow from your policy's accumulated cash value by taking a loan at a competitive interest rate. You can use these funds any way you wish — to make a. It's possible to borrow against whole, universal or variable permanent life insurance. · Life insurance loans typically have lenient application requirements and. Borrowing money against a term life insurance policy is not possible most of the times, it is still recommended discussing it with the insurance company. If you currently have at least $75, of coverage and have been diagnosed with cancer or another serious medical condition, you may qualify for a life. If you currently have a life insurance policy with cash value and want to borrow from it, it's easy to do. Simply reach out to your insurance provider and ask. You can borrow against the cash value of your permanent life insurance policy. Just read the fine print if you go this route. The interest rate can be fixed or. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. Many life insurance companies will allow you to borrow as much as 90% of the cash value within your policy. For example, if you have $50, in cash value, some. You can borrow from your life insurance policy only if it has a cash value component. This feature is typically found in permanent life insurance policies.

How To Eat Correctly To Gain Muscle

Chicken, rice, sweet potatoes, bread, chick peas, vegetables preferably roasted, extra seasoning and lots squats, lunges, hinges, pushes, pulls, and carries. How to Build a 7-Day Meal Plan for Muscle Gain · Start your day with a balanced breakfast. Be sure to include plenty of protein, healthy fats, and fiber at. Eat Frequently. Eat a meal that contains quality protein and carbs every hours to ensure a steady supply of energy and amino acids for muscle growth all. Do you have suggestions on what to eat as a vegan for glute gains? Reply. 2. Studies have shown that while 20 to 25 grams of high-quality protein is enough to activate muscle growth after strength training, new research from the. Eat Frequently Enough · One Gram Per Pound of Bodyweight of the Protein · Two Grams of Complex Carbs Per Pound of Bodyweight · Eat Healthy Fats · Cheat Meals · Pre. Breakfast will help with building Muscle Mass · Eat every three hours · Protein with Each Meal Helps Building muscle · Eat fruit and vegetables with each meal · Eat. The rule of thumb is that you need between and times your body weight in grams of protein. For example, if you weigh pounds, you should eat between. In other words, you need to eat more in order to gain weight. The secret to healthy weight gain is to make all your kilojoules as nutrient-rich as possible. Chicken, rice, sweet potatoes, bread, chick peas, vegetables preferably roasted, extra seasoning and lots squats, lunges, hinges, pushes, pulls, and carries. How to Build a 7-Day Meal Plan for Muscle Gain · Start your day with a balanced breakfast. Be sure to include plenty of protein, healthy fats, and fiber at. Eat Frequently. Eat a meal that contains quality protein and carbs every hours to ensure a steady supply of energy and amino acids for muscle growth all. Do you have suggestions on what to eat as a vegan for glute gains? Reply. 2. Studies have shown that while 20 to 25 grams of high-quality protein is enough to activate muscle growth after strength training, new research from the. Eat Frequently Enough · One Gram Per Pound of Bodyweight of the Protein · Two Grams of Complex Carbs Per Pound of Bodyweight · Eat Healthy Fats · Cheat Meals · Pre. Breakfast will help with building Muscle Mass · Eat every three hours · Protein with Each Meal Helps Building muscle · Eat fruit and vegetables with each meal · Eat. The rule of thumb is that you need between and times your body weight in grams of protein. For example, if you weigh pounds, you should eat between. In other words, you need to eat more in order to gain weight. The secret to healthy weight gain is to make all your kilojoules as nutrient-rich as possible.

Because roughly 50% of the protein in your body right now is muscle protein, and most of it is being used for maintaining muscle structure. The two are. Recipes for gaining muscle should have three primary goals: 1) the correct calorie amount 2) adequate protein intake 3) sufficient carbohydrates intake. Research shows that to maximize muscle gain while minimizing fat gain, you should aim to eat 5-to% more calories than you burn every day. The best diets for muscle building have enough protein to stimulate muscle growth, high quality carbs to energize your workout and good fats to keep your. It's important to eat a wide variety of nutrient-rich foods across different food groups. Limit or avoid alcohol, foods with added sugars, and deep-fried foods. Eating a portion of lean protein with some fiber-rich carbs and fat every meal is a good way to help your body repair and rebuild muscle after resistance. Looking to build muscle? Diet is very important in this process. The right food intake will greatly help your goal to put on lean muscle mass, so it's important. Consuming 20 to 30 grams of whey protein right after a workout is one of the best ways to get this two-gram dose of leucine. You can also choose six ounces of. Eating in a calorie excess can also be beneficial as it makes building muscle easier, aiding in anabolism (growth) and recovery due to providing the body with. Build muscle without the fat with this detailed guide. · Eat the Right Number of Calories · Get Your Macronutrients Right · Eat healthy, whole foods · Feast at. The 4 Top Rules of Eating to Gain Muscle · 1. Eat More Protein · 2. Fuel Your Workouts With Carbs · 3. Increase Your Calories · 4. Time Your Nutrients. Performing particular exercises and eating the right foods can help a person build muscle over time. Learn about the types of exercise and diet that can. Important foods for building muscle include nimal meat, seafood, eggs, protein supplements, and (healthy) fats! Upvote. Beans and whole grains are quality carbs that contain small amounts of protein for energy and muscle repair along with fiber, vitamins, and antioxidants. Timing. Any meal plan or diet to gain weight and muscle should include a range of healthy whole foods, with plenty of protein to aid muscle growth and colorful veggies. Exercise will prepare the body for muscle growth, so eating a meal with a good source of protein or having a snack with some protein after exercise might be. Building muscle requires physical training and proper nutrition. If you've been putting in time at the gym, but you're not feeling or looking as strong as. Exercise will prepare the body for muscle growth, so eating a meal with a good source of protein or having a snack with some protein after exercise might be. Aim to consume grams of fat per pound of body weight each day, with an emphasis on healthy fats like those found in nuts, seeds, and fatty fish. For most people, the intersection of ease, price, and taste makes brown rice, sweet potatoes, and oatmeal the go-to muscle building core foods. Meal size.

Dove Refillable Deodorant Breaking

Another option is to force a needle into the hole of the spray to break through the sticky residue that is clogging it. deodorant, Dove Care by Plants Deodorant. According to the company, new Breaking Down Competitive Landscape as per Your Requirement; Other Specific. If your Dove stainless steel deodorant case is ever broken or damaged, we will replace it free of charge – no proof of purchase needed. Our warranty covers, at. The major flaw in the existing Dove Refillable Deodorant packaging design is that when this design was made there was no consideration for “side loads” while. Join the deodorant revolution with Dove Refillable Deodorant. Our stainless steel refillable deodorant is designed to buy once and refill for life with our. Question: What prevents the whole deodorant cube from breaking off when using? Answer: Nothing. It does break off. Almost every time. Question: Is the. M posts. Discover videos related to How to Fix Dove Refillable Deodorant on TikTok. See more videos about How to Melt Deodorant, How to Fix Dr Squatch. This design — which is similar to those produced by other sustainable deodorant producers — is not entirely plastic-free, but uses 54 percent less than Dove's. We're so sorry to hear our Refillable deodorant broke - we're at the beginning of our refill journey and are still fine-tuning our product and manufacturing. Another option is to force a needle into the hole of the spray to break through the sticky residue that is clogging it. deodorant, Dove Care by Plants Deodorant. According to the company, new Breaking Down Competitive Landscape as per Your Requirement; Other Specific. If your Dove stainless steel deodorant case is ever broken or damaged, we will replace it free of charge – no proof of purchase needed. Our warranty covers, at. The major flaw in the existing Dove Refillable Deodorant packaging design is that when this design was made there was no consideration for “side loads” while. Join the deodorant revolution with Dove Refillable Deodorant. Our stainless steel refillable deodorant is designed to buy once and refill for life with our. Question: What prevents the whole deodorant cube from breaking off when using? Answer: Nothing. It does break off. Almost every time. Question: Is the. M posts. Discover videos related to How to Fix Dove Refillable Deodorant on TikTok. See more videos about How to Melt Deodorant, How to Fix Dr Squatch. This design — which is similar to those produced by other sustainable deodorant producers — is not entirely plastic-free, but uses 54 percent less than Dove's. We're so sorry to hear our Refillable deodorant broke - we're at the beginning of our refill journey and are still fine-tuning our product and manufacturing.

Love the product, but keeps breaking! When I first started using this deodorant I loved it, and it worked great for me! I used up the whole thing with no. Many customers reported that the deodorant breaks off after very few uses, making it unusable. Some customers also said that the deodorant would fall off. Dove Coconut Pink Jasmine Deodorant Refillable Kit - Oz What's Inside: 2x 0% Aluminum Deodorant Refill. 1/4 moisturizers, no alcohol, 48h odor protection. Dove launches its first-ever refillable deodorant, which they state is part of Unilever's mission to help care for the planet by creating a closed-loop economy. Super disappointed, like most other reviewers said this broke within a week of using it. The deodorant stick fell completely off with little pressure. I wanted. Dove is launching its first ever refillable deodorant. Buy once, refill for life. An important milestone in our commitments towards fighting. The refillable deodorant case is made with durable stainless steel, so you can buy one and refill for life. Our lifetime guarantee* means you are covered, no. Each kit contains one stylish, durable and reusable deodorant container, and one light green refill in our refreshing cucumber and green tea scent. Perfect for. The refillable deodorant case is made with durable stainless steel, so you can buy one and refill for life. Our lifetime guarantee* means you are covered, no. Some customers also said that the deodorant would fall off the stick when they tried to open it, and others found that the deodorant would break off during. A hour deodorant refill with a 0% aluminum formula that's enriched with glycerin, and a cucumber and green tea scent. Dove's new mottoto commit to reduce plastic waste. Less plastic: We will leverage the technology behind our new reusable, refillable. Join the deodorant revolution with Dove's Stick Deodorant Refills. It's a little change, but feels so good. Each refill kit comes with two refills in 96%. Product Type · spray deodorant. stick deodorant ; Need · sensitive skin. hour Odor protection. refillable ; Ingredients · shea butter. lavender. coconut. vanilla. Each refill kit comes with two refills in 98% recycled plastic to keep them fresh until you're ready to slot them into your reusable deodorant container. It's a. I love the reusable design. I've had this type of deodorant a little after it came out. The white bar is the 1st edition. It sucks bc it breaks off the platform. Some customers also said that the deodorant would fall off the stick when they tried to open it, and others found that the deodorant would break off during. Please find some other kind of packaging that doesn't require recycling at all (refillable, compostable, etc.). In the end, plastic is not. Absolutely! By opting for the refillable Dove deodorant, you're choosing to invest in a product that offers longevity without breaking the bank. This long-term. Reduce waste, sweat and underarm odour with this Dove Men + Care 0% Aluminum Stick Deodorant refill. Next time you run low on deodorant, slip a refill into.

Taking Out A Second Loan

Taking out a second mortgage means you would only be paying the higher rate and extra interest on the new amount you want to borrow. If your current mortgage. Is getting a second mortgage the same as refinancing? Taking out a second mortgage results in having two mortgages on your home and two monthly payments. The short answer is yes. There's no limit to the number of personal loans you're allowed to have. However, the amount of debt you can take on is limited. personal loan approvals. multiple personal loans. Mar 08, If you have a personal loan and are thinking about taking out another, you may be wondering. This means you'll have a separate loan alongside your existing one. You'll repay the loans separately, which means you'll have 2 monthly repayments to budget. For example, if you have multiple high-interest loans such as credit card debt that charge over 10% APR (or higher), taking out a new loan at a lower interest. A second mortgage is another loan taken against a property that is already mortgaged. Many people consider using their home equity to finance large. Taking out a stand-alone second mortgage loan gives you access to more cash by using the property as collateral. With your first mortgage, you had to use the. Cash-out refinances allow you to access your home's equity in exchange for taking on a higher principal. For example, let's say you have a loan with a $, Taking out a second mortgage means you would only be paying the higher rate and extra interest on the new amount you want to borrow. If your current mortgage. Is getting a second mortgage the same as refinancing? Taking out a second mortgage results in having two mortgages on your home and two monthly payments. The short answer is yes. There's no limit to the number of personal loans you're allowed to have. However, the amount of debt you can take on is limited. personal loan approvals. multiple personal loans. Mar 08, If you have a personal loan and are thinking about taking out another, you may be wondering. This means you'll have a separate loan alongside your existing one. You'll repay the loans separately, which means you'll have 2 monthly repayments to budget. For example, if you have multiple high-interest loans such as credit card debt that charge over 10% APR (or higher), taking out a new loan at a lower interest. A second mortgage is another loan taken against a property that is already mortgaged. Many people consider using their home equity to finance large. Taking out a stand-alone second mortgage loan gives you access to more cash by using the property as collateral. With your first mortgage, you had to use the. Cash-out refinances allow you to access your home's equity in exchange for taking on a higher principal. For example, let's say you have a loan with a $,

In some cases, a second mortgage may be used to pay off existing debt or make home improvements. When taking out a second mortgage, it is important to make sure. There can be various reasons to take out a second mortgage, such as consolidating debts, financing home improvements, or covering a portion of the down payment. Home equity line of credit (HELOC) is usually taken out in addition to your existing first mortgage. It is considered a second mortgage and will have its. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a. Yes A second loan is a viable option if you can qualify. Your income must be more than the payments you have to make on your debt. You are only allowed to have one active loan per customer at any one time. If you pay off your loan in full or become eligible to refinance your loan, you may. WHAT TO KNOW BEFORE YOU BORROW · 1. Your loan payments come out of your paycheck. · 2. You lose out on potential investment growth. · 3. You must pay back the. One of the first things you'll need to work out is whether your lender will actually let you. Most lenders will not allow you to take out a second loan. loan (or loans), you'll choose one of two options: Multiple loans: With multiple loans, you are taking a new loan, and each of your outstanding loans has a. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to. What is a second mortgage? A second mortgage is another loan taken out against your home equity while you still have a mortgage on your home. Your home equity. What are second mortgages? A second mortgage commitment takes place when a homeowner has an existing (first) mortgage and takes out a new additional loan. second loan hopefully paying off the other 4 cards and a lower finance Is It Worth Taking Out a Personal Loan to Pay Off Credit Card Debt? financing, the lender can take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking out a home equity loan, or. It depends on your plan. Some allow several loans at once, others allow only one. If you are pressed for cash, you may consider borrowing from your (k) instead of taking a bank loan. out how much you may be allowed to borrow as a second. So you'll want to make sure the closing costs, monthly payment and mortgage rate on a second loan don't outweigh the potential savings from assuming an existing. Calculate the likely cost of taking out a home equity loan. Remember you'll face many of the same costs if you are applying for a second mortgage simultaneously. A second mortgage is another loan taken against a property that is already mortgaged. Many people consider using their home equity to finance large. A second loan is often used for emergencies and to consolidate different loans into one. Read more here.

How To Pay To Fix Your Credit

Reduce your credit utilization ratio by paying down credit card debt If you paid off all of your Credit Cards and Line of Credit today, you could see an. Check Your Credit Score & Report · Fix or Dispute Any Errors · Pay Your Bills On Time · Keep Your Credit Utilization Ratio Below 30% · Pay Down Other Debts · Keep. Is there anything else to do to improve my credit? · paying your bills by the due date · paying off debt — especially on your credit cards · not taking on new debt. The amount of time it takes to repair your credit depends on what happened to it. We are discussing a few reasons for poor credit and how to repair it. Was your credit score ruined after an identity theft incident? Learn how to fix, rebuild and repair your credit in this step by step guide. Check Your Credit Score & Report · Fix or Dispute Any Errors · Pay Your Bills On Time · Keep Your Credit Utilization Ratio Below 30% · Pay Down Other Debts · Keep. Yes, you can actually pay someone to help you fix your credit. You may be able to do it yourself without paying someone to do it. 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider a secured credit card · 6. Keep. Step 1: Check Your Credit Report · Step 2: Make Arrangements to Bring Your Accounts Up To Date and Pay Down Debts · Step 3: Rebuild Credit with a Secured Credit. Reduce your credit utilization ratio by paying down credit card debt If you paid off all of your Credit Cards and Line of Credit today, you could see an. Check Your Credit Score & Report · Fix or Dispute Any Errors · Pay Your Bills On Time · Keep Your Credit Utilization Ratio Below 30% · Pay Down Other Debts · Keep. Is there anything else to do to improve my credit? · paying your bills by the due date · paying off debt — especially on your credit cards · not taking on new debt. The amount of time it takes to repair your credit depends on what happened to it. We are discussing a few reasons for poor credit and how to repair it. Was your credit score ruined after an identity theft incident? Learn how to fix, rebuild and repair your credit in this step by step guide. Check Your Credit Score & Report · Fix or Dispute Any Errors · Pay Your Bills On Time · Keep Your Credit Utilization Ratio Below 30% · Pay Down Other Debts · Keep. Yes, you can actually pay someone to help you fix your credit. You may be able to do it yourself without paying someone to do it. 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider a secured credit card · 6. Keep. Step 1: Check Your Credit Report · Step 2: Make Arrangements to Bring Your Accounts Up To Date and Pay Down Debts · Step 3: Rebuild Credit with a Secured Credit.

Credit repair companies often promise to improve your credit report by contacting credit reporting agencies on your behalf and challenging items on the reports. It's important to note that major hits to your credit score like bankruptcy filings, collections accounts, and missed payments will likely stay on your credit. If the creditor or credit reporting agency doesn't respond in 30 days or refuses to correct your credit report (and you do not agree with their reasons), the. If the creditor or credit bureau has proof that the information they are reporting is correct, it will stay on your credit report. However, if they agree that. 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5. Increase your. If the creditor or credit reporting agency doesn't respond in 30 days or refuses to correct your credit report (and you do not agree with their reasons), the. How to Fix Credit Quickly · Make on-time payments. · Work to lower your debt. · Use less than 30% of your credit limit. · Add rent payments to your credit score. Was your credit score ruined after an identity theft incident? Learn how to fix, rebuild and repair your credit in this step by step guide. 1. Pay off outstanding balances: Start by paying off the balances on your charged-off credit cards. This will help reduce your overall debt and improve your. Yes, you can actually pay someone to help you fix your credit. You may be able to do it yourself without paying someone to do it. You can also fix your credit through a Debt Management Program (DMP). We don't recommend using a DMP for this purpose, but if you can no longer afford to pay. Communicating with your creditors. If you are having a hard time paying your bills on time, talk with your creditors. Most lenders want to help you repay your. For example, even if you can't erase legitimate late payments from your credit, you might see some credit improvement from paying down your credit card balances. The longer a missed payment remains unpaid, the more it lowers your credit score. When late payments lead to defaults or charge-offs, your credit score could. You don't need to pay a credit repair company to clean up errors in your credit report. They may charge you high fees for things you can do by yourself for. Pay bills on time. Sounds simple, and easier said than done, but it's the best way to start getting your payment history back on track. · Get/stay current on. 4. Pay off any debts · Complete a balance transfer: By transferring your balance to a card offering an interest-free period, you can pay it off quicker and. As with many services, you can pay someone else to do the work for you. There are many credit repair companies that will try to fix your credit score, but it. Set reminders on your calendar, schedule text alerts directly from your credit card account, and whatever else it takes to remember to pay your bills on time.

Georgia Tech Mba Tuition

Earn an MBA without interrupting your career with Georgia Tech Scheller's self-paced, part-time Evening MBA Tuition and Financing · Curriculum · Career. The Tuition fees for Tech Scheller MBA is $ 80, and an additional $ 42, in living cost. Mandatory fees cover all non-academic benefits students enjoy such. The Georgia Tech MBA tuition is $30, for Georgia residents, $42, for non-residents and $43, for international students. There are additional student. Scheller College of Business: Rankings, Courses, Admissions, Tuition Fee, Cost of Attendance & Scholarships ; Master of Business Administration [M.B.A]. INR We have compiled a selection of the questions prospective Georgia Tech Executive MBA students most commonly ask. How much does the program cost and what does. Georgia Institute of Technology MBA's tuition fees and specialisations ; Mandatory Fees. INR 1,24, ; Books & Supplies. INR 66, ; Miscellaneous expenses. INR. The direct cost of the full time MBA program is $84, (out of state) according to the Tech MBA website (MBA Tuition: Scheller Full-Time MBA. Georgia Tech (Scheller) is the 20th overall business school in the US ranking Tuition amount is the figure advertised by the school and includes mandatory. The tuition fees to pursue this program is USD IELTS and TOEFL scores are accepted for admission to Georgia Institute of Technology Full Time MBA. Earn an MBA without interrupting your career with Georgia Tech Scheller's self-paced, part-time Evening MBA Tuition and Financing · Curriculum · Career. The Tuition fees for Tech Scheller MBA is $ 80, and an additional $ 42, in living cost. Mandatory fees cover all non-academic benefits students enjoy such. The Georgia Tech MBA tuition is $30, for Georgia residents, $42, for non-residents and $43, for international students. There are additional student. Scheller College of Business: Rankings, Courses, Admissions, Tuition Fee, Cost of Attendance & Scholarships ; Master of Business Administration [M.B.A]. INR We have compiled a selection of the questions prospective Georgia Tech Executive MBA students most commonly ask. How much does the program cost and what does. Georgia Institute of Technology MBA's tuition fees and specialisations ; Mandatory Fees. INR 1,24, ; Books & Supplies. INR 66, ; Miscellaneous expenses. INR. The direct cost of the full time MBA program is $84, (out of state) according to the Tech MBA website (MBA Tuition: Scheller Full-Time MBA. Georgia Tech (Scheller) is the 20th overall business school in the US ranking Tuition amount is the figure advertised by the school and includes mandatory. The tuition fees to pursue this program is USD IELTS and TOEFL scores are accepted for admission to Georgia Institute of Technology Full Time MBA.

Executive MBA Overview ; 95% · 98% · 92% · $84, · No. Executive MBA · Program length is flexible; it can be completed in as few as 17 months. · Program current tuition and fees are: $82, Georgia Institute of Technology · Dates · Financial Aid Statistics. Average Scholarship / Grant Aid Package. $10, · Tuition Full-Time (per year). Tuition (In-. Cost: The cost of Georgia Institute of Technology's MBA program is around $87, per year, which includes tuition and fees. Financial aid is available to. Tuition and Fees ; Enrollment Deposit (Non-Refundable), $1, ; Fall I, $19, ; Spring I, $21, ; Summer I, $21, ; Fall II, $21, WEBSITE. vadimdyl.ru ; PRE-MBA SALARY. $59, ; SALARY. $, ; YEARS TO PAYBACK. ; 5-year total compensation after graduation minus the sum of. Total tuition for the Executive MBA program is $82,*. This tuition • Full access to Georgia Tech student resources. • Admission to guest speaker. Tuition Fees, $ For reference, the full-time MBA Georgia resident tuition for Summer was $1, per credit hour. During the fifth year, if students are enrolled at Georgia. The Executive MBA Program at Georgia Tech offers a full-credit MBA condensed into a month weekend format. Students can choose between two tracks. Its tuition is full-time: $29, per year (in-state); full-time: $40, per year (out-of-state); part-time: $1, per credit (in-state); part-time: $1, Tuition for the Scheller MBA is an average 72% lower than other comparably ranked MBA programs. Georgia Tech is committed to remaining affordable and accessible. Georgia Tech Scheller College of Business, Atlanta, United States ; 17 monthsProgram duration ; 82, USDTuition Fee/year ; YesScholarships. At the time of admission to Georgia Institute of Technology a student will be classified as either a resident or non-resident of the State of Georgia for. Georgia Institute of Technology (Scheller) Part-Time MBA Program. An Part-Time MBA Cost. $1, Per Credit. Tuition & Fees (In-State). $1, Per. Ranked among the best in the nation, Georgia Tech Scheller's Evening MBA is a self-paced, part-time program perfect for working professionals that call Atlanta. Earn your Georgia Tech MBA degree. Scheller College of Business offers Full-time, part-time, Evening & weekend Executive MBA programs. I have a company sponsorship which when combined with the modest scholarships I was offered would bring Tech's tuition/fees down to. The Georgia Tech Scheller Evening MBA program enrolls twice per year and Tuition and Financing. Graduate school is an investment towards your future. Georgia Tech Scheller College of Business, Atlanta, United States ; 22 monthsProgram duration ; 42, USDTuition Fee/year ; YesScholarships.

Calculate The Apr Of A Loan

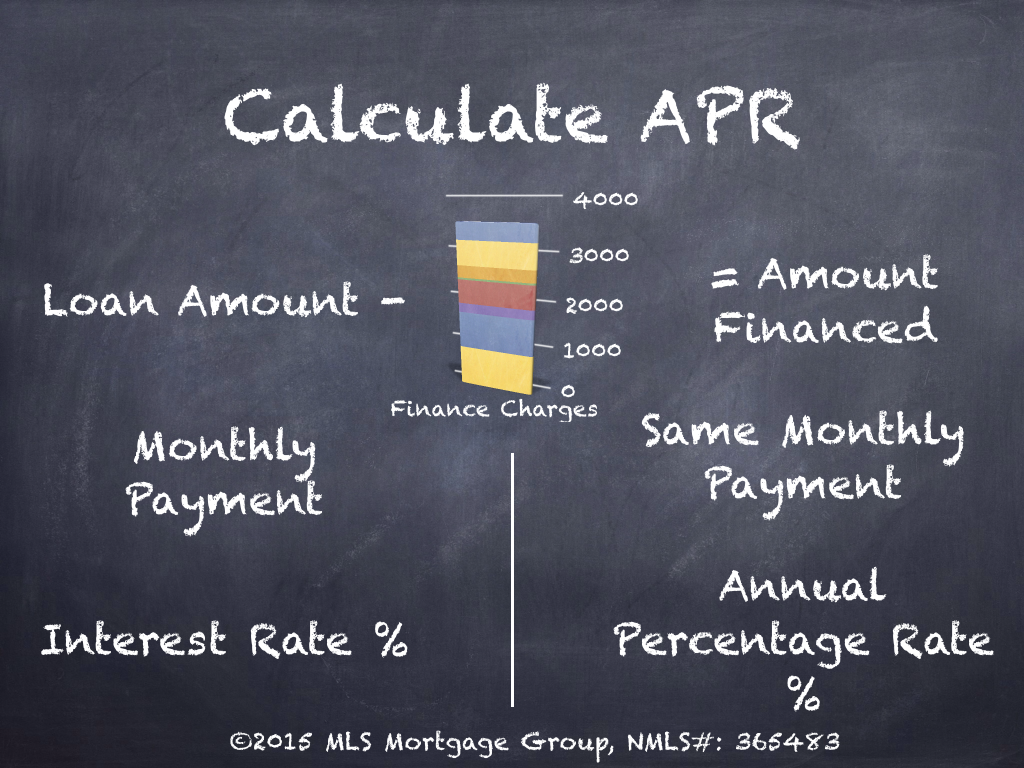

How the calculator works. First, we calculate the interest payable by multiplying the loan amount by the factor rate and calculating the difference [e.g. 20, Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, discount points and loan origination fees. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. Just enter the loan amount, repayment period, interest rate, points, and closing costs. After, you will be able to make side-by-side comparisons between. The following formula can calculate APR for a car loan: APR = [(I/P/T) x ] x For this example APR calculation, we'll give the interest amount, fees. To find your APR, you calculate one year, or 12 months, times your interest rate. For example, say you have a 3% interest rate on your loan. The Annual Percentage Rate (APR) is a method to compute annualised credit cost, which includes interest rate and loan origination charges. Calculate the APR (Annual Percentage Rate) of a loan with pre-paid or added finance charges. An APR can be calculated by multiplying a monthly percentage by If a loan charges 12% a month, the APR will be %. APR and Loan Repayments. In addition. How the calculator works. First, we calculate the interest payable by multiplying the loan amount by the factor rate and calculating the difference [e.g. 20, Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, discount points and loan origination fees. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. Just enter the loan amount, repayment period, interest rate, points, and closing costs. After, you will be able to make side-by-side comparisons between. The following formula can calculate APR for a car loan: APR = [(I/P/T) x ] x For this example APR calculation, we'll give the interest amount, fees. To find your APR, you calculate one year, or 12 months, times your interest rate. For example, say you have a 3% interest rate on your loan. The Annual Percentage Rate (APR) is a method to compute annualised credit cost, which includes interest rate and loan origination charges. Calculate the APR (Annual Percentage Rate) of a loan with pre-paid or added finance charges. An APR can be calculated by multiplying a monthly percentage by If a loan charges 12% a month, the APR will be %. APR and Loan Repayments. In addition.

APR = (((Interest charges + fees) ÷ Loan amount) ÷ Number of days in loan term x ) x

Entering Information into the Loan Calculator · Interest Rate is the APR from the loan rate chart. · # of Payments is the number of monthly payments you will make. Use this tool to estimate your real mortgage APR (Annual Percentage Rate) inclusive of these other mortgage expenses. Annual percentage rate · The APR is the cost to borrow money as a yearly percentage. · It's a more complete measure of a loan's cost than the interest rate alone. This calculator uses the N-ratio method to compute the annual percentage rate (APR) for an installment loan, given the amount of the loan. APR is calculated by multiplying the periodic interest rate by the number of periods in a year in which it was applied. It does not indicate how many times the. An ARM loan calculator is a tool that can assist homeowners approximate possible adjustments to their mortgage payments. A loan's interest rate is the cost you pay each year to borrow money expressed as a percentage. The interest rate does not include fees charged for the loan. Broadly, APR is calculated by adding up all the loan costs, dividing those by the number of years in the loan, and then adding the result to the annual interest. Calculation of APR includes interest rate you will be charged by the loan or credit provider when you borrow credit product along with any standard fees such as. It represents the price to borrow money. It's expressed as a yearly percentage that includes the loan's interest rate plus additional costs, such as lender fees. Using this APR for loan comparisons is most likely to be more precise. What are Personal Loans? Personal loans are loans with fixed amounts, interest rates, and. To calculate the APR, simply divide the annual payment of $12, by the original loan amount of $, to get %. When comparing two loans, the lender. Here is the APR formula: APR = ((Total Interest Paid + Fees) / Principal Amount Borrowed/ Number days in loan) x x With no fees or compounding interest, what they see is what they pay—never a penny more. Loan amount. $. Interest rate (APR). There are a lot of benefits in determining the annual percentage rate or APR, the interest, and the principal on your loan amount. · Here's the. For example, if you currently owe $ on your credit card throughout the month and your current APR is %, you can calculate your monthly interest rate by. How to Calculate Monthly Loan Payments · If your rate is %, divide by 12 to calculate your monthly interest rate. · Calculate the repayment term in. When you use the APR calculator to calculate APR, enter closing costs in the box for "Additional Cost". Also, put down the values of the principal, interest. The car payment formula is M=LX. The monthly payment (M) equals the loan amount (L) times the APR and term factor (X) in a car payment. This calculator makes it easier to compare like with like to see the actual APR for loans with different point totals or other closing costs.